Understanding Cryptocurrency in Simple Terms

Cryptocurrency, also called crypto or crypto-currency, is a digital, virtual, currency built on cryptography to keep transactions secure. Unlike money controlled by a central issuing or regulating authority, it runs on a decentralized system where every record helps issue new units. In my early exposure to this space, what stood out was how control shifts away from institutions and into code, which completely changes how trust works.

How Cryptocurrency Is Used in the Real World

At its core, cryptocurrency is a digital payment system that lets people move value without banks that verify transactions. It works peer-to-peer, meaning users can send and receive payments without touching physical money in the real world. Instead, everything lives in an online database, where each transfer of funds is recorded in a public ledger and stored in digital wallets. Behind the scenes, encryption, advanced coding, storing, and transmitting data across wallets and public ledgers focus on security and safety. Bitcoin, the first crypto founded in 2009, became the best known asset, attracting people who trade for profit, including speculators chasing rising prices.

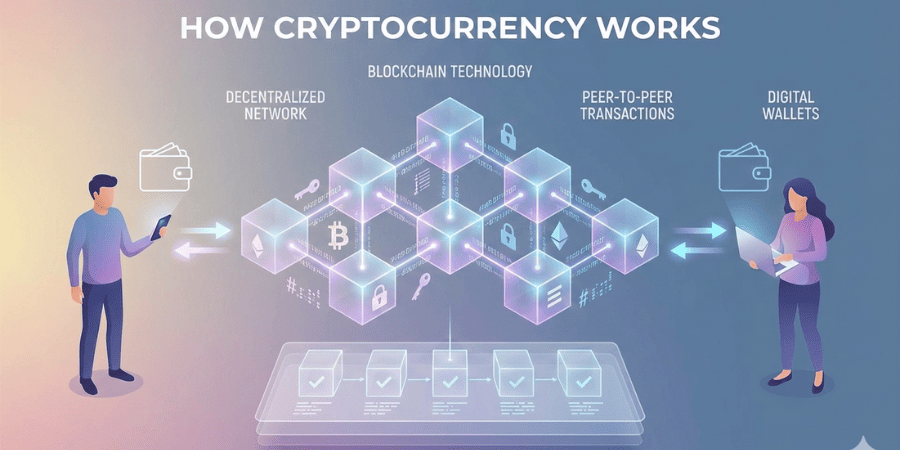

How Cryptocurrency Actually Works

Most cryptocurrencies rely on a distributed public ledger called a blockchain, where every record of transactions is updated and held by currency holders. New units are created through mining, using computer power to solve complicated mathematical problems that generate coins. Users can buy currencies from brokers, store or spend them using cryptographic wallets. You don’t own anything tangible—you own a key that lets you move a unit of measure from one person to another without a trusted third party. Since Bitcoin launched in 2009, applications of blockchain technology have been emerging, with financial uses expanding into future markets like bonds, stocks, and other assets that could be traded.

Popular Cryptocurrency Examples

There are many cryptocurrencies, but Bitcoin remains the first and most commonly traded, linked to Satoshi Nakamoto, a pseudonym believed to represent an individual or group whose identity remains unknown. Ethereum, launched in 2015, is a blockchain platform powered by Ether (ETH) and is highly popular. Litecoin followed bitcoin, adding innovations like faster payments and more efficient transactions. Ripple, a distributed ledger system founded in 2012, works with banks and financial institutions. All non-Bitcoin coins are grouped as altcoins.

Buying Cryptocurrency the Smart Way

To buy cryptocurrency safely, there are clear steps. First, choose a platform, either a traditional broker or an exchange. These online services let you sell or buy financial assets like stocks, bonds, and ETFs, with different trading costs, features, wallet storage, interest-bearing account options, fees, security, and withdrawal tools, plus educational resources. After funding your account, you can trade using fiat government-issued currencies such as the US Dollar, British Pound, or Euro, via debit or credit cards, though this can be risky due to volatile prices and debt from transaction costs. Other payment methods include ACH, wire transfers, deposits, and withdrawals. Orders can be placed on mobile or web platforms, or through PayPal, Cash App, and Venmo. Advanced investors use Bitcoin trusts, brokerage shares, mutual funds, ETFs, or blockchain companies, aligning investment risk with long-term goals.

Storing Cryptocurrency Securely

Once you own cryptocurrency, you must store it safely to avoid hacks or theft. Most people use crypto wallets, either physical devices or online software, to protect private keys. Some exchanges offer built-in wallet services, while others rely on third-party platform providers. Hot storage stays connected online, while cold storage uses hardware, offline electronic tools to hold keys securely, sometimes charging fees.

What You Can Buy With Cryptocurrency

Originally, Bitcoin aimed to support daily transactions, from coffee to a computer or even real estate, but wide accepting remains rare. Still, many products are sold through e-commerce websites and technology companies like newegg.com, AT&T, Microsoft, Overstock, Shopify, Rakuten, Home Depot, and retailers offering luxury goods. Platforms like Bitdials sell Rolex, Patek Philippe watches. Some cars dealers, including mass-market sellers, accept crypto. In April 2021, AXA allowed payment for most insurance except life due to regulatory issues, while Premier Shield in the US accepts crypto via debit card tools like BitPay.

Cryptocurrency Fraud and Scams to Watch

Sadly, cryptocurrency crime is rising. Scams include fake websites, false testimonials, confusing jargon, and promises of guaranteed returns through investing. Ponzi schemes run by criminals advertise non-existent opportunities, targeting investors like in the BitClub Network, which raised $700 million before being indicted in December 2019. Celebrity endorsements, fake billionaires, messaging apps, chat rooms, and rumours fuel romance scams, flagged by the FBI through dating social media. The Internet Crime Complaint Centre logged 1,800 reports in 2021, with losses of $133 million. Other risks include fraudsters, bogus exchanges, fake retirement accounts, hacking, and drained digital wallets.

Is Cryptocurrency Safe to Use?

Most cryptocurrencies rely on blockchain technology, where blocks are time stamped into a digital ledger that’s hard for hackers to tamper with. Security uses two-factor authentication, including username, password, code, text, and phone verification. Even so, major hacks like Coincheck ($534 million) and BitGrail ($195 million) in 2018 proved risks remain. Since crypto isn’t government-backed, supply and demand drive volatility, causing sharp gains or losses, with limited regulatory protection compared to stocks, bonds, or mutual funds.

Smart Tips for Investing Safely

According to Consumer Reports, every investment carries risk, and cryptocurrency is no exception. Research exchanges, read reviews, and learn from experienced investors—there are over 500 platforms. Know how to store digital currency in wallets with strong security. Diversify beyond Bitcoin, since there are thousands of options. Expect volatility in the market, shifting prices, and protect your portfolio and mental wellbeing. This space is still speculative, in its infancy, with real challenges, so invest conservatively.

Cryptocurrencies Worth Watching

Today’s cryptocurrencies include Bitcoin, altcoins, and tokens, all influenced by volatile conditions. Seek professional investment advice and study the industry. By market capitalization on April 3, 2025, Bitcoin (BTC) reached $1.63 trillion, secured by blockchain cryptographic puzzles, priced at $82,413 USD. Ethereum (ETH) stood at $215.67 billion, supporting decentralized applications. Tether (USDT) hit $144.17 billion as a stablecoin tied to the United States dollar. USD Coin (USDC) followed at $60.91 billion. XRP, linked to Ripple, reached $119.25 billion. Cardano (ADA) held $22.61 billion, enabling staking. Solana (SOL) emerged in 2021, while Avalanche (AVAX) uses proof-of-stake (PoS) for speed and efficiency.